41+ reverse mortgage interest tax deductible

The deduction is limited to interest paid on no more than 100000 of loan. Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility.

Pdf Inequality Household Debt Ageing And Bubbles A Model Of Demand Side Secular Stagnation

Secured by that home.

. Homeowners who bought houses before December 16. Compare Our List Of Popular Reverse Mortgage Lending Companies Quickly and Easily. For tax year 2022 those amounts are rising.

Also if your mortgage balance is. Web June 5 2019 1201 PM. For Homeowners Age 61.

Web In addition to the potential deduction for a reverse mortgages mortgage interest payments taxpayers can also potentially deduct mortgage insurance premiums as mortgage qualified personal residence interest under IRC Section 163 h 3 E. However higher limitations 1 million 500000 if married. Again check with your tax professional.

Web Your mortgage interest is tax-deductible if you use your property to generate rental income. Any interest including original issue. Come tax time you would use the rental income and expenses.

Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Ad Founded In 1909 Mutual Of Omaha Is A Company You Can Trust. Web According to the IRS Because reverse mortgages are considered loan advances and not income the amount you receive is not taxable. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Web The interest deduction would be taken by whoever repays the loan for a reverse mortgage.

You can normally deduct interest on the first 750000 of your loan 375000 if married filing separately. For Homeowners Age 61. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Web Loan Size. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. The good news if you have a bigger.

Get A Free Information Kit. Web If you took out your mortgage on or before Oct. You can deduct amounts you paid for qualified mortgage insurance premiums on a reverse mortgage.

Web There are other factors to consider as well. Ad Our Reviews and Recommendations Are Trusted By 45000000 Customers. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

In a 52-week span the lowest rate was 445 while the. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Reverse mortgage debt is treated in the same manner as home equity debt according to the IRS.

Web When it comes to paying points on your reverse mortgage some may be deductible if they satisfy certain statutory or IRS criteria. You can fully deduct home mortgage interest you pay on acquisition debt if. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You.

AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Ad Compare the Best Reverse Mortgage Lenders. Web Todays average rate on a 30-year fixed-rate mortgage is 713 which is 004 higher than last week.

Web Up to 96 cash back Used to buy build or improve your main or second home and. Get A Free Information Kit. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

13 1987 your mortgage interest is fully tax deductible without limits.

Journal Of The Military Balance Chapter Vi By Iiss Hilman Adzim Academia Edu

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

6 Tax Breaks Every First Time Homeowner Should Know About

![]()

Repayment Of The Hecm Loan Balance And The Tax Issues

Pdf New Social Policy Agendas For Europe And Asia Katherine Marshall Academia Edu

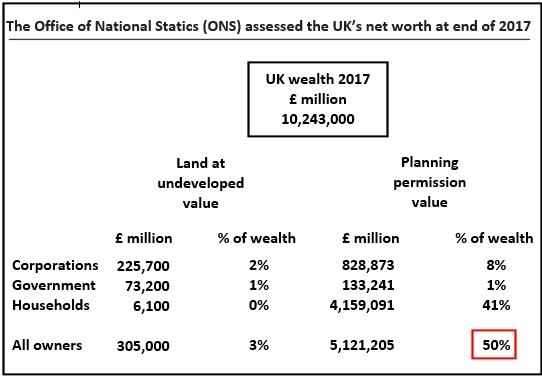

A Little Help From Land Value Tax Ideas From Brussels And York Brussels Blog

Gary Owen Mortgage Broker Port Macquarie Nsw Mortgage Choice

Gutting The Mortgage Interest Deduction Tax Policy Center

How To Deduct Reverse Mortgage Interest Other Costs

Reverse Mortgages And Taxes

Pdf Sexual Dimorphism Of The Developing Human Brain Judith Rapoport Academia Edu

Which States Benefit Most From The Home Mortgage Interest Deduction

Reverse Mortgages And Taxes Retirement Living 2023